Announcing The Once In A Lifetime M&A Market

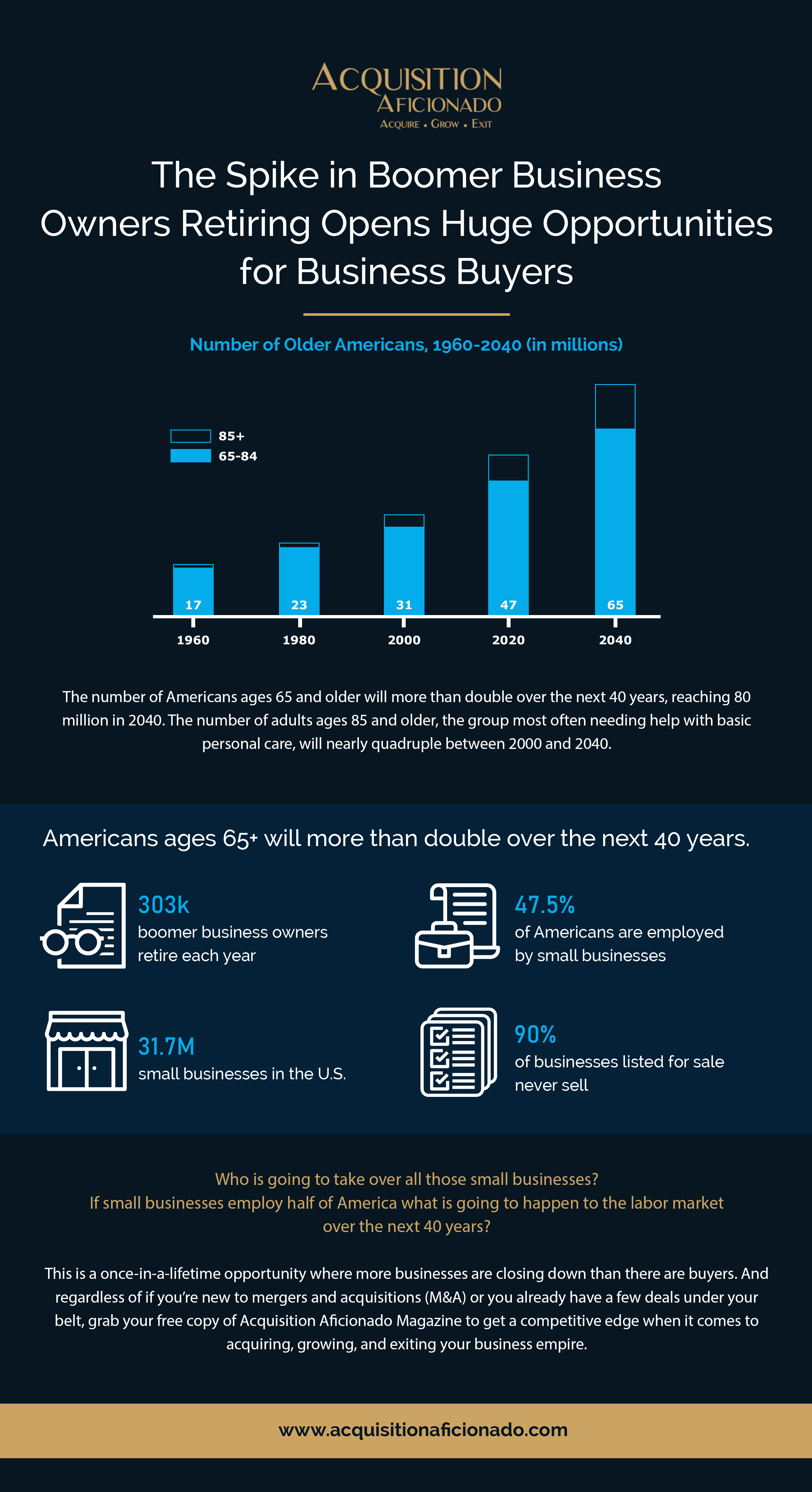

This infographic explains why the 2020s will be the best time in recorded history to acquire companies:

- The COVID-19 pandemic contributed to business owners’ burnout.

- More baby boomer businesses need to change hands than there are buyers, with the peak of retiring boomers projected to happen between 2020 and 2040.

- An average of 303,000 businesses are closing down or hitting the market every year this decade, and most of what’s listed will never sell.

- Private equity firms have 3.4 trillion U.S. dollars in global dry powder (idle money).

- Lastly, the looming economic downturn is starting soon or already started, based on your perspective, will lower business multiples and increase the number of motivated business sellers.

Whether or not you’ve acquired a company already, you’ll regret not taking action this decade.

Gain the competitive edge by downloading the latest copy of The Acquisition Aficionado Magazine for FREE!

Visit https://acquisitionaficionado.com/blog/ now.

About Edgar Fernandez

Edgar Fernandez is a Marketing & Growth consultant at Acquire Scale & Exit (ASE). His experience and areas of focus include IT, Telecommunications, Cloud Computing, Cybersecurity, Amazon FBA, and financial engineering to get M&A transactions to pay for themselves. His board at Great Western Technologies is actively investing in IT Companies.

Learn More About Edgar Fernandez at https://www.acquirescaleandexit.com